Medicaid offers extensive health insurance despite the lower costs.-- If you're under 30 or satisfy income requirements, you might get approved for a devastating health insurance. These plans provide lower premiums but come with much higher deductibles and out-of-pocket costs. The strategies cover young and individuals with low-income who couldn't afford a routine medical insurance plan. The concept behind catastrophic strategies is to provide coverage to avoid financial mess up if they have emergency situation health care requirements. Unlike short-term health insurance, which don't cover lots of services, catastrophic strategies use the exact same level of protection as a standard ACA plan. The health insurance market is the ACA exchanges site, making it simple for people to compare specific health insurance.

That's the place to start when looking for your choices. Not all insurance providers offer strategies through the government-run marketplace. You can discover more options by going shopping directly through health insurance coverage companies that offer strategies outside of the exchanges. That will take more work to compare the insurers, however you might also find a plan that better fits your requirements out of the exchanges. When shopping for a private health insurance strategy, you'll wish to consider your healthcare requirements and your spending plan. Inspect the health strategy's network to make sure it has an excellent selection of medical facilities, medical professionals and experts.

This is particularly true if you get an HMO. HMOs have a restricted network and will not spend for the care you get beyond the network. If you get a PPO, you'll likely be able to get out-of-network care, but it can come at a greater rate tag. Examine to see if the prescription drugs you take are included in the strategy's list of covered medications. Compare other advantages. Some plans may go above and beyond coverage mandated by law. You'll likewise want to have a look at the business's customer evaluations and financial standing. You can examine Insure. com's Finest Health Insurance Coverage Companies for client fulfillment ratings and business A.M.

Making a clever specific medical insurance option needs effort and time, but the research you do now will pay off later on when you and your family need care.

8 Easy Facts About What Is Pmi Insurance Explained

If you're not covered through your company, or not eligible for monetary help through a state-funded program, you will likely need to purchase private insurance Website link for specific or family through a personal health insurance coverage provider, such as Independence Blue Cross. You might have the ability to buy a strategy on the Pennsylvania Insurance Coverage Exchange (Pennie, TM), which has actually replaced health care. gov. Start by discovering which private medical insurance carriers are available in your area. Self-reliance Blue Cross serves the Philadelphia and southeastern Pennsylvania areas (i. e. Bucks, Chester, Delaware, Montgomery, and Philadelphia counties). See if private medical insurance plans from Independence are readily available in your POSTAL CODE.

When it pertains to health coverage, everyone has various requirements and preferences. We can help you figure out what type of strategy you want, how to discover a balance of expense and coverage, and what other advantages you should think about. Understanding the features of a health insurance can assist you choose the ideal strategy. This video walks you through a Click here for more few of the basic questions to http://finnzdlr629.theburnward.com/the-9-minute-rule-for-how-much-is-life-insurance check out, such as: Is it crucial for you to be able to see medical professionals out of network or without recommendations? If so, then you may wish to check out PPO plans. If it's not a leading concern, then you may desire an HMO strategy you'll choose a main care physician to collaborate your care and get a network of service providers to select from.

Or look for a strategy with a tiered network you'll conserve money when you visit specific physicians and hospitals. This works best if your service providers are already in the lowest-cost tier, or if you don't mind switching. The finest method to buy health insurance coverage is to get a better understanding of the specific and household plans that are readily available. The Affordable Care Act needs all plans to be arranged by the level of protection they provide. There's likewise a disastrous protection strategy readily available for people under 30, or for those who receive an unique exemption. All plans cover the very same necessary health advantages the difference is what you pay in monthly premium and out-of-pocket costs when you require care.

For instance, a gold health strategy may be best for you if you utilize a great deal of health care services, are able to pay more in monthly premiums, and wish to pay less when you receive care. Gold Silver Bronze Catastrophic Monthly premium $$$$ $$$ $$ $ Cost when you get care $ $$ $$$ $$$$ Good alternative if you ... Tend to utilize a lot of healthcare services Required to stabilize your month-to-month premium with your out-of-pocket expenses Do not use a great deal of health care services Meet the requirements and need "just-in-case coverage" Do not forget, you may be eligible for a tax credit (subsidy) to help you spend for your medical insurance premium, out-of-pocket costs, or both.

The Definitive Guide for What Is Casualty Insurance

We provide five primary types of plans: HMO, PPO, EPO, HMO Proactive with a tiered network, and EPO Reserve with a health savings account (HSA). All of Self-reliance's plans offer you the widest option for quality care in the area, with more than 49,000 doctors and 180 medical facilities to pick from. PPO strategies are great if you desire a little bit more flexibility and versatility, while HMO plans might give you a lower premium, since you pick a medical care physician (PCP) to coordinate your care and refer you to professionals. The following chart reveals the key differences in between health insurance types: HMO HMO Proactive PPO EPO EPO Reserve with an HSA In-network coverage X X X X X Out-of-network coverage X National access with heaven, Card network X X X Requires choice of a main care doctor X X No recommendations required for specialists X X X Consists of a tiered network so you can select when to save on care X Option of opening a tax-advantaged HSA X. What is gap insurance.

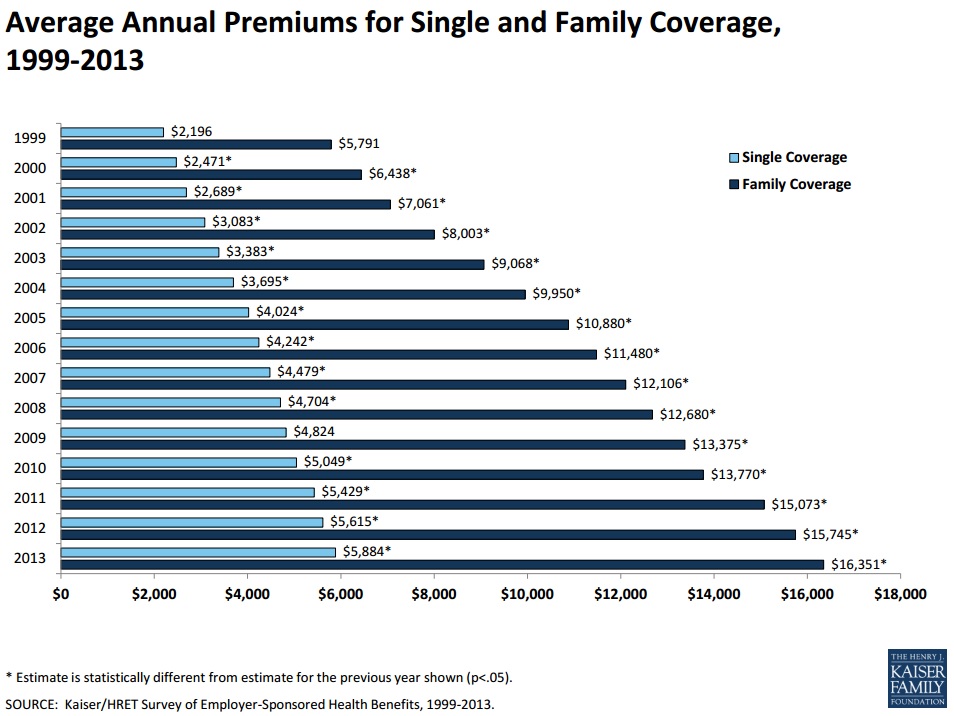

When it concerns health insurance coverage expenses, from a small business owner's viewpoint, the premium-- payments made to the insurer every month for coverage is frequently the most important number to consider. Here are 3 ways to get a sense for what you can expect to spend for worker health benefits. The typical yearly premium cost for single coverage in 2017 as $6,690, with companies paying 82% of that. 1 A company's contribution is typically not the exact same for single staff member and household protection. In fact, one-third of workers in little companies (3-199 employees) contribute more than 50% of the overall family premium.